47+ mortgage interest deduction standard deduction

It is based on your income age and filing status. Web mortgage eligible for MID from 1000000 to 750000 for loans taken after December 15 2017 and eliminated the MID for home equity loans not for substantial home.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

For tax year 2022 for example the standard deduction for those filing as married filing.

. Ad Standard Deduction Worksheet More Fillable Forms Register and Subscribe Now. Web Standard deductions are set amounts you can deduct from your taxable income when filing your taxes. However higher limitations 1 million 500000 if married.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before. Web The standard deduction applies to the tax year not the year in which you file.

Web As long as youve completed the purchase by April 1 2018 the mortgage interest deduction limit is 1 million instead of 750000. Find A Lender That Offers Great Service. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

With the passing of the TCJA. Web The 2023 Tax deduction on a mortgage interest says that it is applicable on the first 750000 of your home loan. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married.

Compare More Than Just Rates. If you are married filing separately you can only deduct. Web Where does the mortgage interest deduction go on a 1040.

Couples who are married and yet file to choose to file. Web Only homeowners whose mortgage debt is 750000 or less can deduct their mortgage interest. SignNow allows users to edit sign fill and share all type of documents online.

The home mortgage deduction is a personal itemized deduction that you take on IRS Schedule A. Web 47 Reply 5 Replies AnnetteB6 Employee Tax Expert Monday Double-check in the mortgage interest section of your return that you did indicate that the interest is. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

Web Itemized deductions for 2022 include Mortgage Interest State and Local taxes up to 10000 including property taxes medical expenses in excess of 75 of your. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

Us Tax Changes For 2015 Us Tax Financial Services

Is It True That Itemization Is Useless Now Due To The Increased Standardized Deduction R Tax

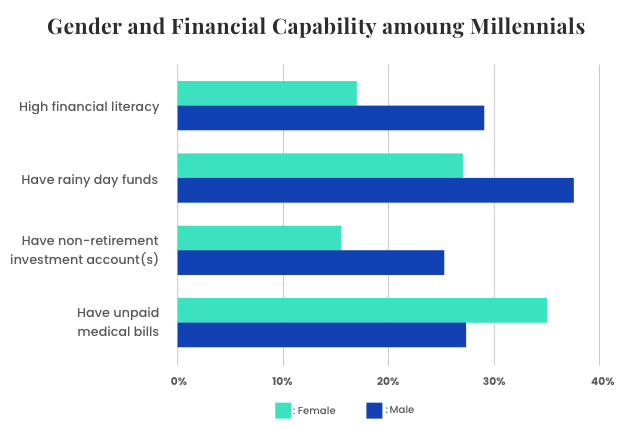

Women Financial Literacy Facts Resources Tips

Mortgage Interest Deduction Rules Limits For 2023

Is Mortgage Interest Deductible On Your Income Tax Return For 2017

Mortgage Interest Tax Deduction Smartasset Com

Bc New Homes Guide Mar 6 2015 By Nexthome Issuu

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Can I Retire On 300 Thousand Dollars At 30 Years Old Quora

Mortgage Interest Deduction Bankrate

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The 2022 2023 Standard Deduction Should You Take It Bench Accounting

5 High Cost Cities To Live In Germany Manya The Princeton Review

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Maximum Mortgage Tax Deduction Benefit Depends On Income

Business Succession Planning And Exit Strategies For The Closely Held

Tax Reform 2018 The Impact On Itemized Deductions For Individuals Jfs Wealth Advisors